In many cases a party may receive recurring cash gifts from family. For example if the father earns 40000 per year and the mother earns 60000 per year combined 100000 per year then the father is responsible for 40 of the child support while.

How Much Will My Child Support Payment Be Supportpay

Use the eligibility calculator to find out if you are eligible for Colorados programs and services to keep residents healthy.

. Divorces and separations finalized before January 1 2019. The Basics You Should Know About Child Support Calculations in Colorado. The main factors include.

3 annual overnights with each parent. Under Colorado Revised Statutes Section 14-10-115 a parents adjusted gross income refers to his or her gross income minus pre-existing child support and alimony obligations. For more information on how child support is calculated see Child Support in Colorado.

What is considered income for child support in colorado SHARE. For example Colorado generally considers the interest earned on your IRA account to be income that should be included in the child support calculation. Colorado follows the income shares method of calculating support which says that children are entitled to a portion of each parents income.

In Colorado child support is calculated by applying a mathematical formula called the child support guidelines The guidelines help make support awards uniform and predictable. The Guidelines provide calculated amounts of child support up to a combined adjusted gross income level of. Dont include as income.

The noncustodial parents share of support sets the amount of the order. It is important to understand exactly what the law considers income when determining a child support award. As of 2014 if you or your family are currently enrolled in CICP you might now be eligible for Health First Colorado Colorados Medicaid program.

These restrictions may vary by state. 1 monthly income of both parties. Income Part 1 In Colorado numerous factors go into calculating child support.

Child support for amounts in excess of 15000 monthly may be more but shall not be less than the amount that would be computed using the 15000 monthly income unless other permissible deviations exist. Under Colorado law the amount of child support that is determined in a child support action is typically tied to the income of the parties. 3000000 per month 36000000 per year.

Unrealized Parental Income and Child Support. 5 the childrens share of health. Home child colorado for income what is considered income for child support in colorado.

Many of these programs are available to those that meet certain requirements including income requirements. These cases establish a clear precedent that any free housing benefits may not be considered strictly income per se but will likely be considered under Family Code section 4057 as a possible special circumstances adjustment to child support. Total net income exceeds 15000 monthly.

Federal Poverty Level Calculator. Other sources of unrealized income that the state may rule should be included are unrealized gains from unexercised stock options and retained earnings from corporations partnerships or sole proprietorships. What is considered income for child support in colorado.

Colorado calculates child support using the Income Shares Model of support which is based on the gross income of both parents and general information about what intact families spend on their children. Disposable Income Gross Pay - Allowable Deductions. You can find out if you qualify for Health First Colorado Child Health Plan Plus CHP or other programs like food assistance by visiting our How to Apply page or by calling t oll free.

RECURRING CASH GIFTS FROM FAMILY. 4 work and education related child care costs. As a non-custodial parent the one who cares for the child less than 50 of the time you will be required to pay child support to the other party the custodial parent.

Based on this economic evidence the colorado child support guideline calculates child support based on each parents share of the amount estimated to have been spent on the child if the parents and child were living in an intact household1 if. Wednesday March 23 2022. Divorces and separations finalized on or after January 1 2019.

Each court order for child support should cite any applicable state regulations. The more income a party has the greater is their share of support obligation. Basically child support guidelines include as income any source of funds available to the parent taking into consideration all possible financial sources.

Income can refer to more than just the wages you earn at. Those income numbers are based on the Federal Poverty Level FPL. Voluntary deductions such as 401 k contributions and health and life insurance are generally considered part of disposable income.

Much of the confusion of the definition of income in many states comes from the fact that state child support statues do not define exact inclusions for income. Dont include qualified distributions from a designated Roth account as income. What is considered income for child support in colorado.

The starting point for determining the child support payments in Colorado is the pre-tax income of each parent. Depending on the circumstances it is possible for social security benefits retirement benefits loan proceeds and stock option sales proceeds to also be considered income in terms of child support. Calculation of the gross income of each parent gross income being income from any source other than child support payments public assistance a second job or a retirement plan.

2 number of children. Child support is a percentage roughly 20 for 1 child and an additional 10 for each additional child of the combined gross income of the parents which is then split between. This article examines what Colorado considers as income in determining child support obligations.

How Child Support Amount is Determined. Amount of child support ordered to be paid exceed the amount of child support that would otherwise be ordered to be paid if the parents did not share physical custody. 3 annual overnights with each parent.

Parents support child care and health care obligatoin shall not reduce net monthly income below 687.

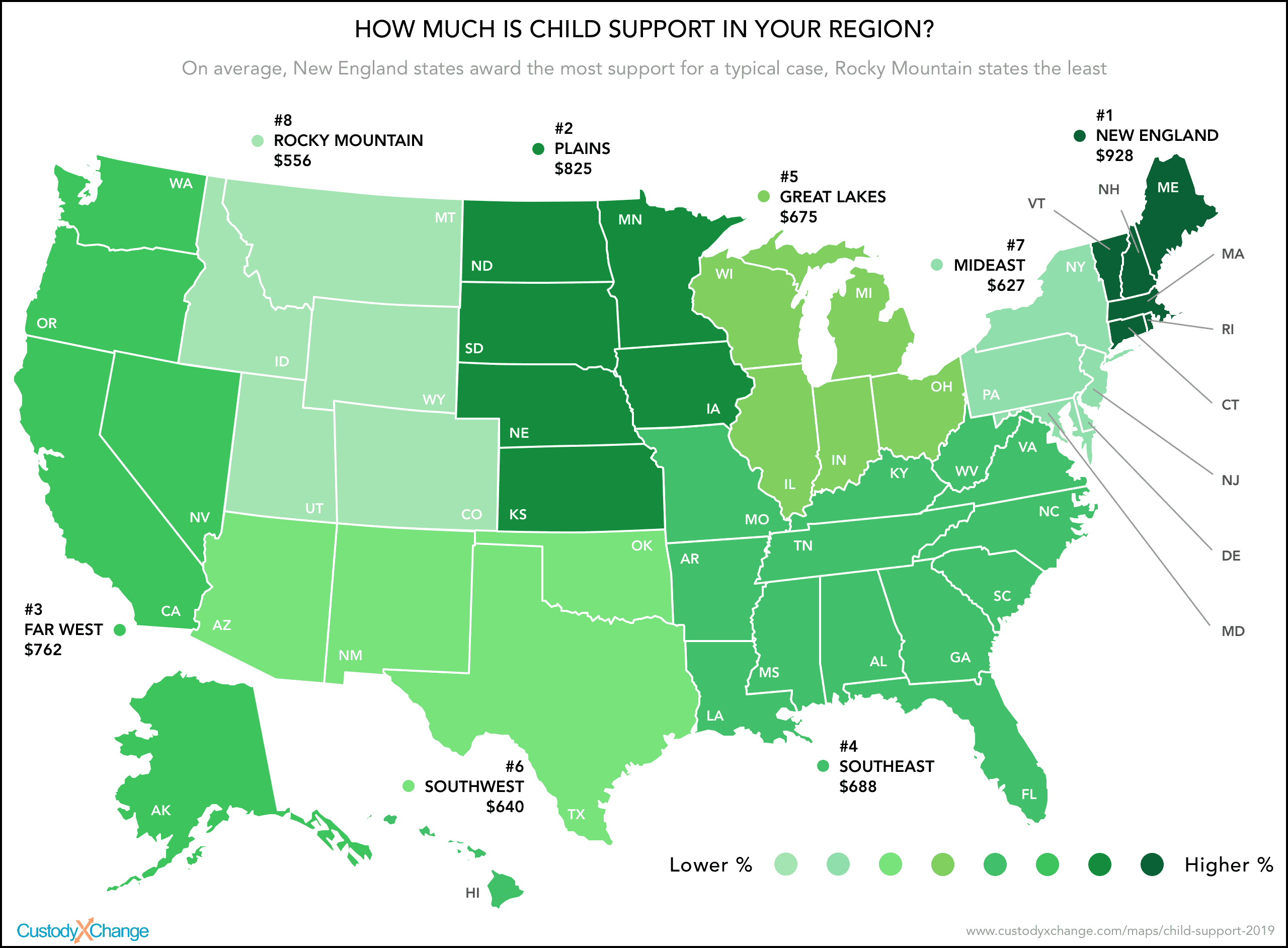

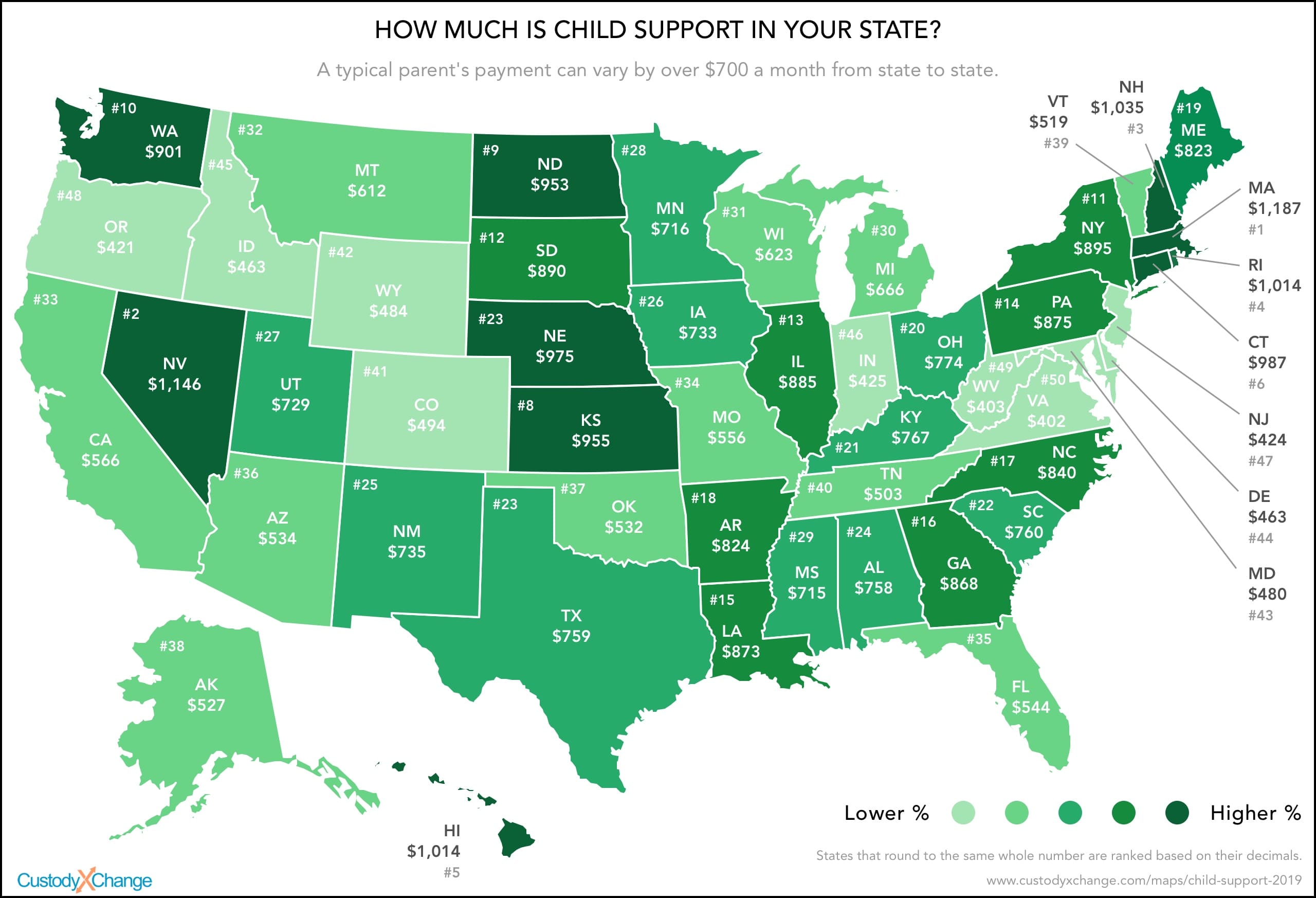

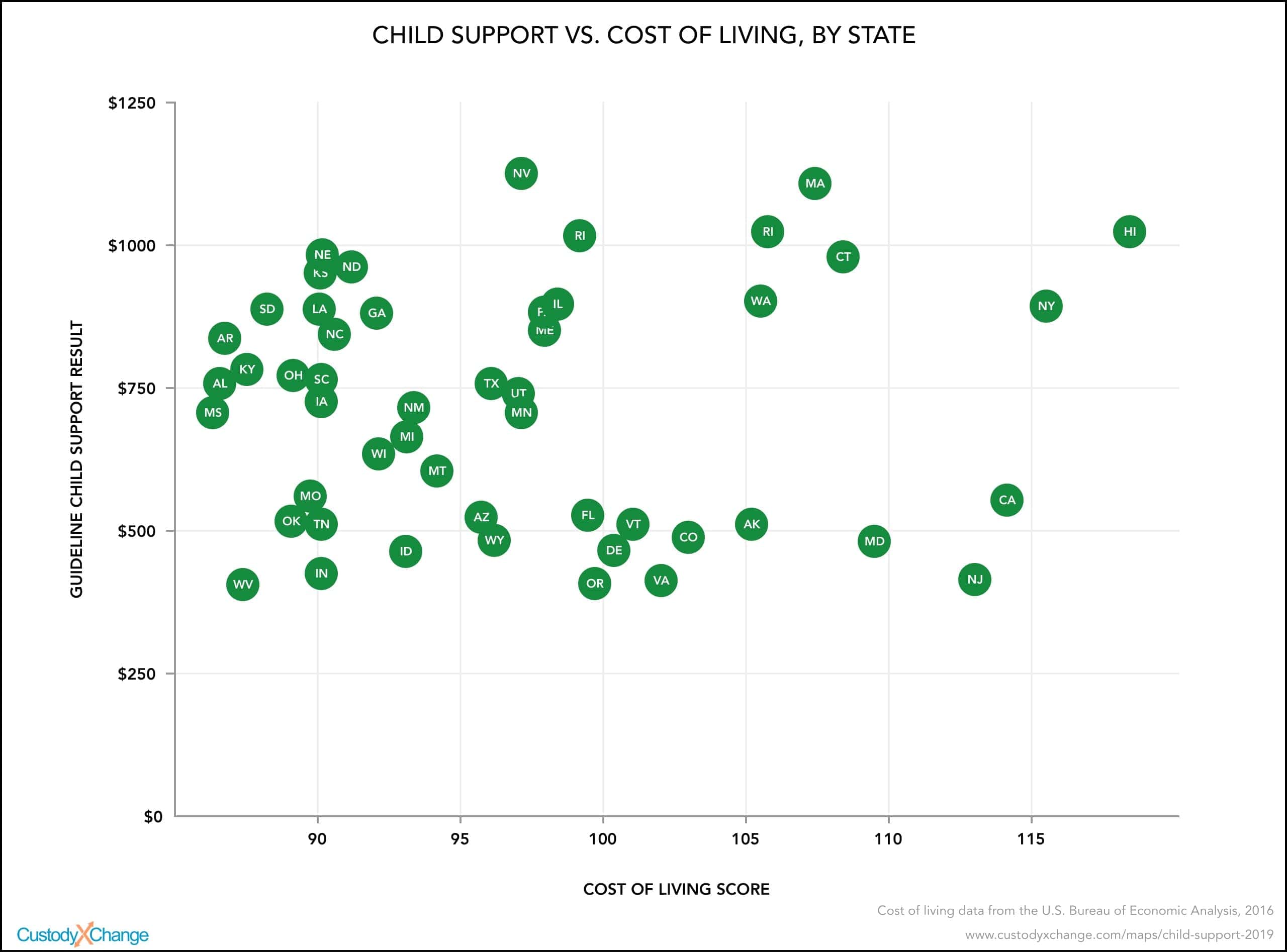

Child Support An Essential Guide 2022

How Much Is Child Support In Your State Custody X Change

Child Support Agreement Template Check More At Https Nationalgriefawarenessday Com 13355 Child Support Agreeme Custody Agreement Child Support Support Letter

How Child Support Is Determined When A Parent Has No Income

Ors Child Support Calculator Utah Child Support Quote Calculate Child Support Payment Between You And Child Support Quotes Child Support Child Support Laws

Child Support An Essential Guide 2022

Do I Have To Pay Child Support If I Share 50 50 Custody

How To Modify A Child Support Order In Colorado

Calculate Child Support Payments Child Support Calculator Colorado Company Announces Online Solution To Calcul Child Support Quotes Child Support Supportive

Did You Know Child Support Calculator Use Child Support Calculator And Find Out Who Should Be Paying Child Support Quotes Child Support Laws Child Support

Child Support Basic Obligation Colorado Family Law Guide

How To Pay Child Support 7 Tips For Fathers Fatherly

Child Support An Essential Guide 2022

How Much Is Child Support In Your State Custody X Change

Why Do I Pay Child Support With 50 50 Custody Timtab

Child Support An Essential Guide 2022

The Procedures For A Colorado Annulment Are The Same As Those Those For A Divorce Or Legal Separation With Two Legal Separation Divorce Mediation Divorce Help